“True Price Index” utilizing POS data.

Nikkei CPINow - T Index

Request Free Material

High precision price trend display using POS data from 800 stores nationwide.

Retail price trends, trend in sales, allows for multifaceted analysis of price level

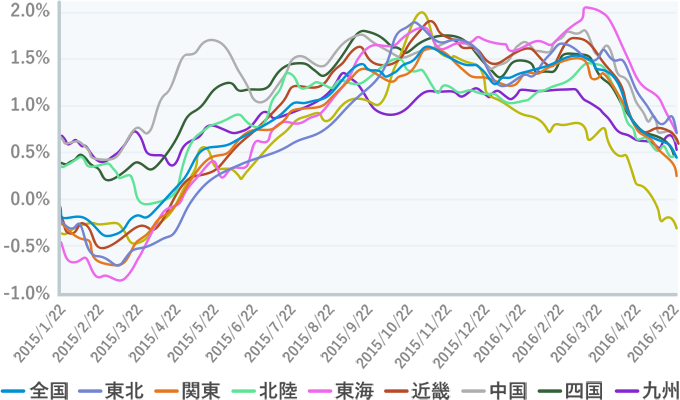

Possible to grasp differences in price increase in each region

T Index utilization example. The BOJ has been using the Nikkei CPINow

T Index utilization example. The BOJ has been using the Nikkei CPINow

T Index for materials and discussion concerning monetary policy decisions

Quoted in Govenor of BOJ Haruhiko Koroda's presentation material

Looking at the movement of the daily and weekly price indexes for food and daily necessities, since last spring there has been a notable trend of expansion observed which has not seen change until recently.

Comparison between the Nikkei CPINow and Hitotsubashi Price Index

Discussed at the Bank of Japan Monetary Policy Meeting

Proceedings of the Monetary Policy Meeting (held in March 2016) VI. Summary of the review of the committee at the time on monetary policy management

Consumer prices (excluding fresh foods and energy) in January decreased compared to the plus width of last year , as a result of sluggish sales due to the warm winter. Taking into account the daily and weekly price movements, it was recognized that there was no change to the long term trend.

Press Conference after the monetary policy decision meeting (December 2015)

Even after looking at corporate pricing behaviour, price revisions since April have continued steadily. The daily and weekly University of Tokyo and Hitotsubashi University price index even show the maintenance of high values.

Source - The Bank of Japan

MODE index allows for in depth analysis of price levels

MODE index allows for in depth analysis of price levels

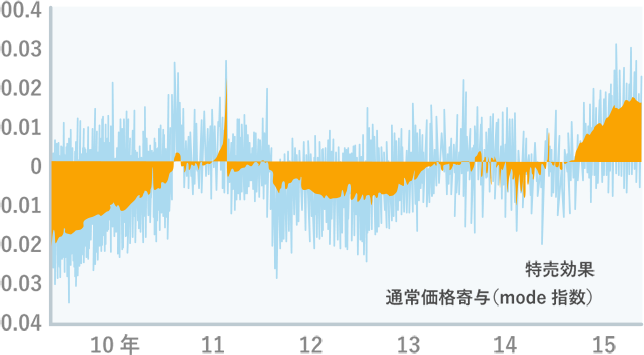

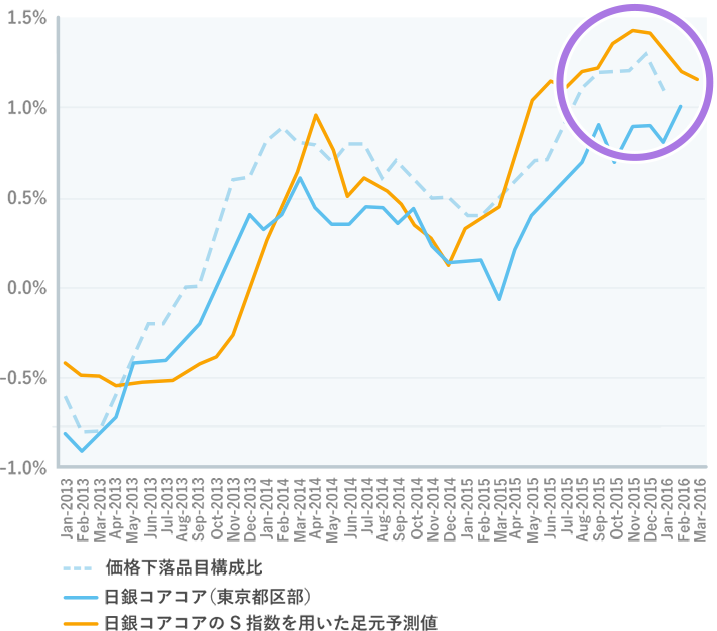

Capture fluctuations in the inflation trend.

Nikkei CPINow / Mode Index

In order to differentiate between temporary movements of prices and long term trends, it is necessary to eliminate noise such as discounts etc. In order to achieve this we need to follow the movement of prices with low noise.

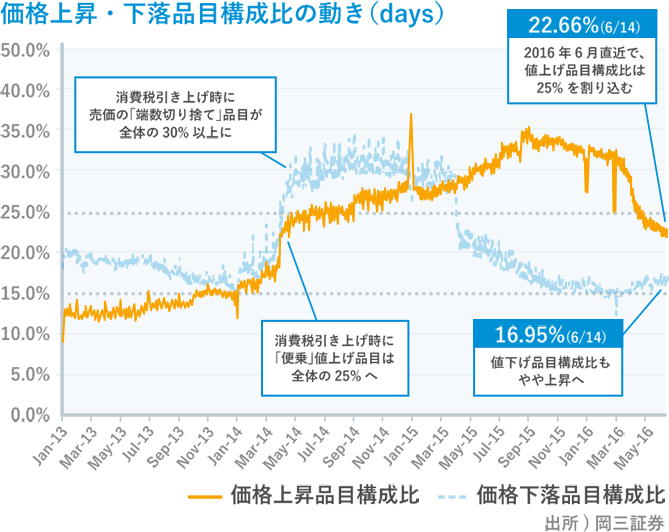

Ratio of items rising in price and items decreasing in price

The end of the inflationary environment

Recently, the component ratio of items decreasing in price has begun to rise. The component ratio of increasing price items and decreasing price items is provided on a daily basis.

Movement of price increase / price decrease items component ratio (days).

increasing in price and decreasing in price

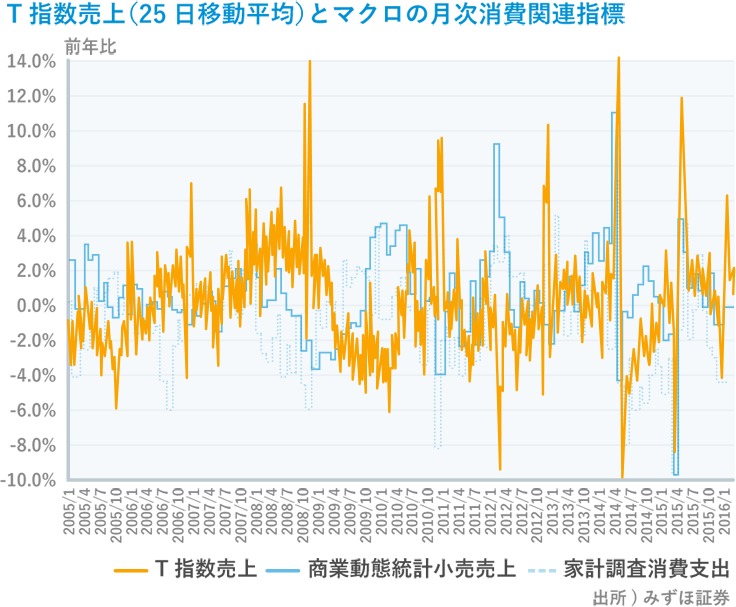

Sales Index:Allows for analysis of consumption in addition to price level

Sales Index:Allows for analysis of consumption in addition to price level

Sales Index that allows for prompt identification of consumption trends

Fastest in the country to grasp consumption trends.

- Daily index provided 2 days after.

- Monthly Index provided on the 3rd of following month.

By looking at the sales and price index together, it is possible to analyze whether the movement in price is being caused by demand / supply factor.

T Index Sales (25-day moving average) and macro monthly consumption related index

Nikkei CPINow by region can capture differences in inflation between different areas

Nikkei CPINow by region can capture differences in inflation between different areas

Definition

- In the vicinity of the city office of subject cities, we compute the price level from the POS data of 30 stores.

Subject cities and data period

- Hokkaido region:01/01/2015

- Tohoku region, Kanto region, Hokuriku region, Tokai region, Kinki region, Chugoku region, Shikoku region, Kyushu region:01/01/2010

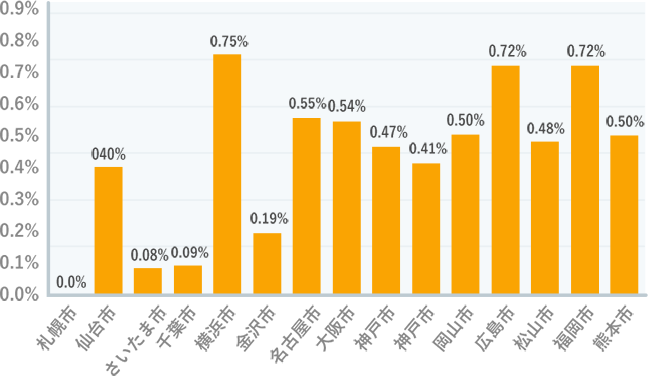

Definition

- In the vicinity of the city office of subject cities, we compute the price level from the POS data of 30 stores.

Subject cities and data period

- Hokkaido region:01/01/2015

- Saitama City, Chiba City, Yokohama City, Osaka City, Kobe City, Nara City:01/01/2015

- Sendai City, Hiroshima City, Fukuoka City:01/01/2015

- Sapporo City:01/01/2015

- Kanazawa City, Nagoya City, Okayama City, Matsuyama City, Kumamoto City:01/01/2015

Stock Brokerage Firm

Economist

Mr A